If you’ve checked your credit score on Credit Karma and then applied for a mortgage, you’ve probably noticed the numbers don’t quite match. That’s because lenders and consumer sites use different credit scoring models.

What Is a FICO Score?

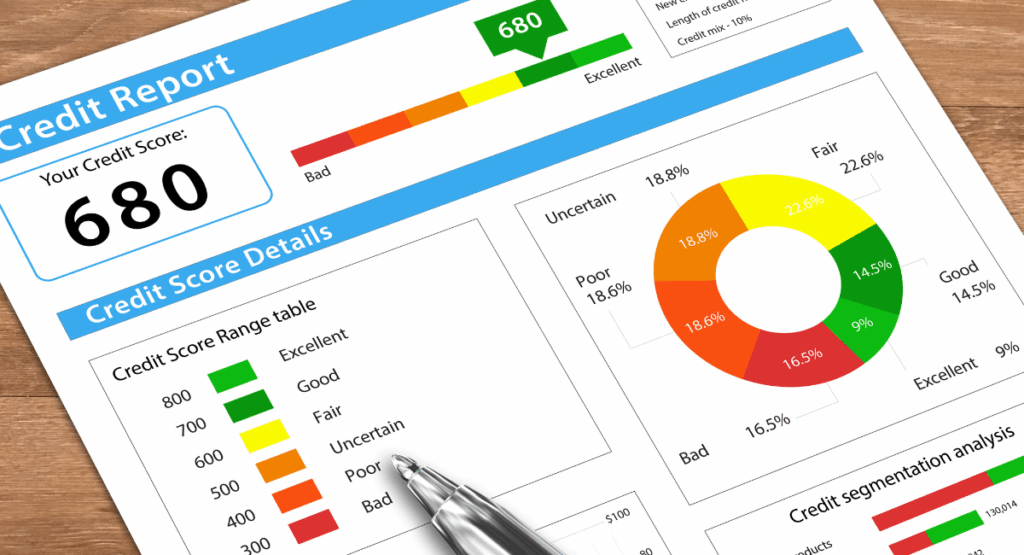

FICO (Fair Isaac Corporation) created the most widely used credit scoring model in the U.S. Your FICO score—ranging from 300 to 850—represents your credit risk and helps lenders decide:

-

Whether to approve your loan

-

What interest rate to offer

-

How much credit to extend

It’s based on five factors:

-

Payment history (35%) – Whether you pay on time

-

Amounts owed (30%) – Your credit utilization

-

Length of credit history (15%) – How long your accounts have been open

-

New credit (10%) – Recent inquiries and new accounts

-

Credit mix (10%) – The types of credit you use

Why It Differs from Credit Karma

Credit Karma shows your VantageScore 3.0, based on TransUnion and Equifax reports. It’s great for tracking trends, but mortgage lenders don’t use it.

Lenders pull FICO scores from all three bureaus—Experian, Equifax, and TransUnion—and use the middle score to qualify you. Because VantageScore and FICO weigh credit data differently, your Credit Karma score can be 20–50 points off from your mortgage score.

👉 Bottom line: Credit Karma is useful for monitoring your credit, but your FICO score is what counts when applying for a mortgage.

Ellen Wilson

703-864-3773

[email protected]

NMLS #591525

Licensed Mortgage Professional

Fidelity Direct Mortgage

8133 Leesburg Pike Suite 700

Vienna, VA 22182